In this article, we will explore 13 ways you can build your emergency savings fast.

One of the easiest ways to protect your finances is by making sure you have a decent sized emergency fund.

Without it, what do would you do during an emergency?

Pull out and swipe a credit card? Take out a personal loan? Or borrow from family?

None of those solutions sound ideal to me, which is why one of the first things I started working on was building my emergency savings.

If you haven’t already heard, only 41 percent of Americans are prepared to handle a $500 emergency. Which is basically saying many are only one paycheck away from a good financial butt whooping if you know what I mean.

If you’re living paycheck to paycheck, it seems impossible to come up with $500 for a car repair, or at the very least have the recommended minimum of $1,000 set aside to cover an insurance deductible.

So, what do you if you run into a situation where you need money before you’ve built a decent sized emergency saving account?

Well, if you need cash in a hurry, there are more than a few ways to handle the expense without going to a payday lender or pulling out your credit card.

Let’s discuss twelve ways you can build your emergency savings fast or come up with money quickly during an emergency!

Related Reading:

6 Side Hustle Ideas to Boost Your Cash Flow

7 Free Online Survey Sites to Join for Extra Cash

12 Ways to Build Your Emergency Savings Fast

1) Sell stuff.

Selling stuff is probably the quickest way to come up with some extra cash when you’re in an emergency.

If you’re on Facebook, there are thousands of Buy/Sell groups for local communities. I’ve seen folks selling cars, refrigerators, furniture, children’s clothes, toys, and small appliances in these groups.

All you have to do is snap a photo, list your price, and wait. About a month ago, I was simply browsing the group and a mom posted a status searching for a rocker for her son’s nursery. I wanted to get rid of mine so I sent her a picture of it and sold it the next day for $75!

You can also try eBay and Craigslist as well. I’ve also seen folks create an account on Instagram (for example, The Confident Kid’s Closet) to get rid of clothing, accessories, shoes, and purses. So, if you’re a blogger or an influencer on Instagram with a large following, you could make a quick buck this way too.

2) Write ten 500 to 700-word articles for $50 to earn a total of $500

If you like to write and hustle online, simply calculate a number of articles you would need to write at your base rate to reach your savings goal.

For example, if you need extra cash by the end of the month and your base rate is $100 — you would need to write ten articles to make a $1,000.

If you don’t already have clients, check out this article on how to land freelance writing clients.

And if you don’t believe me, I did plenty of writing and earned an extra $7,500 last year. That’s how I managed to have a fully-funded quit fund.

Good thing I had it since I got fired😉

3) Drive Lyft in a large nearby city for a month.

If you do this every weekend for a month, you could earn more than enough to boost your emergency savings.

Learn more about how you can earn a $300 bonus driving for Lyft here.

4) Take surveys.

I have a love/hate relationship with surveys and you’ve probably heard bad things about them yourself. However, I still don’t sleep on those little annoying things because I always rack up a generous amount of earnings over the course of the year.

For example, I get around 3 or 4 surveys from Pinecone Research each month. These are a guaranteed payout of $3 per survey. There is also no pre-qualifying survey. Depending on how good of a month I have, I can earn anywhere between $15 to $21 per month.

That’s $180 to $252 per year! They deposit the money directly into my Paypal account. From there I can transfer it to my emergency savings or leave it in my Paypal account and forget about it. It’s nice to go in my Paypal account and see that I’ve accumulated one hundred or so dollars.

Sign up for Pinecone Research here.

5) Sell unused gift cards using Cardpool.

Check your wallet, purses, and junk drawer. How many unused gift cards do you have? What about gift cards you’ve used that have remaining balances?

Yeah, you probably forgot all about those bad boys! That’s like having loose change sitting around the house doing nothing for you.

Fortunately, if you’re not going to use them, you can sell them on sites like Cardpool. Even the used ones too.

6) Complete Ten User Testing gigs for $10 each.

User Testing is a cool website that you sign up for to provide website owners with feedback.

For example, let’s say that www.fingerlickinggood.com wanted feedback on their website. They would submit their website to User Testing and folks like you and me would review it.

You’re required to provide five to twenty minutes worth of feedback on the site.

It requires you to click around, ask questions about the site, and tell what you like and don’t like. User Testing usually gives prompts so you will understand what information the client is looking for

Once your test has been approved, they will pay you $10 in your Paypal account. If you do ten of these a month, you could earn an extra $100 to put in your emergency savings. Learn more about User Testing here.

7) Sign up for Ibotta. Redeem a rebate and refer 10 of your friends for $50.

You can do more with Ibotta than use it to save on groceries. If you have friends that will enjoy using the app, invite them to use Ibotta using your referral link.

If ten of your friends sign up and redeem a rebate you’ll receive $50.

So, sign up for Ibotta here if you haven’t and you’ll earn $10 for redeeming your first rebate. Then refer ten of your friends who like to save money.

Once you reach $20, you can send that cash directly to your Paypal account or redeem it for a gift card of your choice. It’s real easy money!

8) Redeem credit card rewards.

Do you use credit cards (responsibly) that offer rewards? If so, you may have a bunch of rewards accumulating in your account.

Depending on the type of rewards offered, this could be cash you can put into your emergency savings.

However, if you’re not a responsible user of credit (yet), I wouldn’t advise using this strategy simply for the purposes of building an emergency fund!

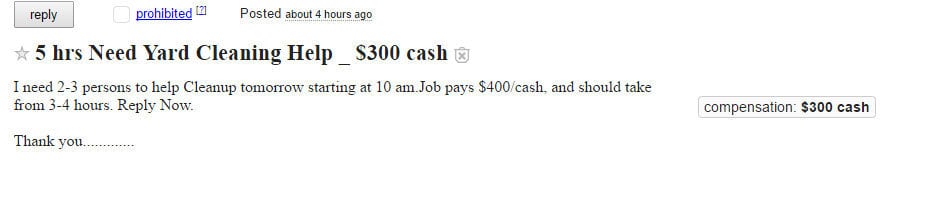

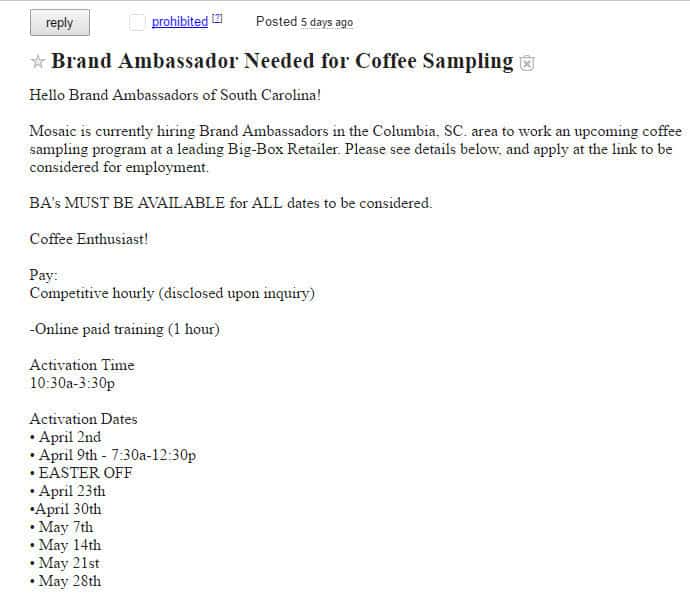

9) Look for random weekend gigs on Craigslist.

Craigslist can be a goldmine for weekend gigs. For example, in my local area, here are two gig listings that I found…

In the first gig, someone needs help cleaning up their yard. They are requesting 2 to 3 people, so you could gather up some of your friends and split the cost for 3 to 4 hours of work.

The second gig is a brand ambassador gig. If the person interested in this gig is available for all of these dates listed, this could be a great way to boost up their emergency savings.

The interested worker would need to inquire about compensation, but this one looks promising. Here is more information on how to become a brand ambassador.

Last, there’s always some caveats when it comes to Craigslist. Of course, I would try to stay away from gigs like this one below for obvious reasons!

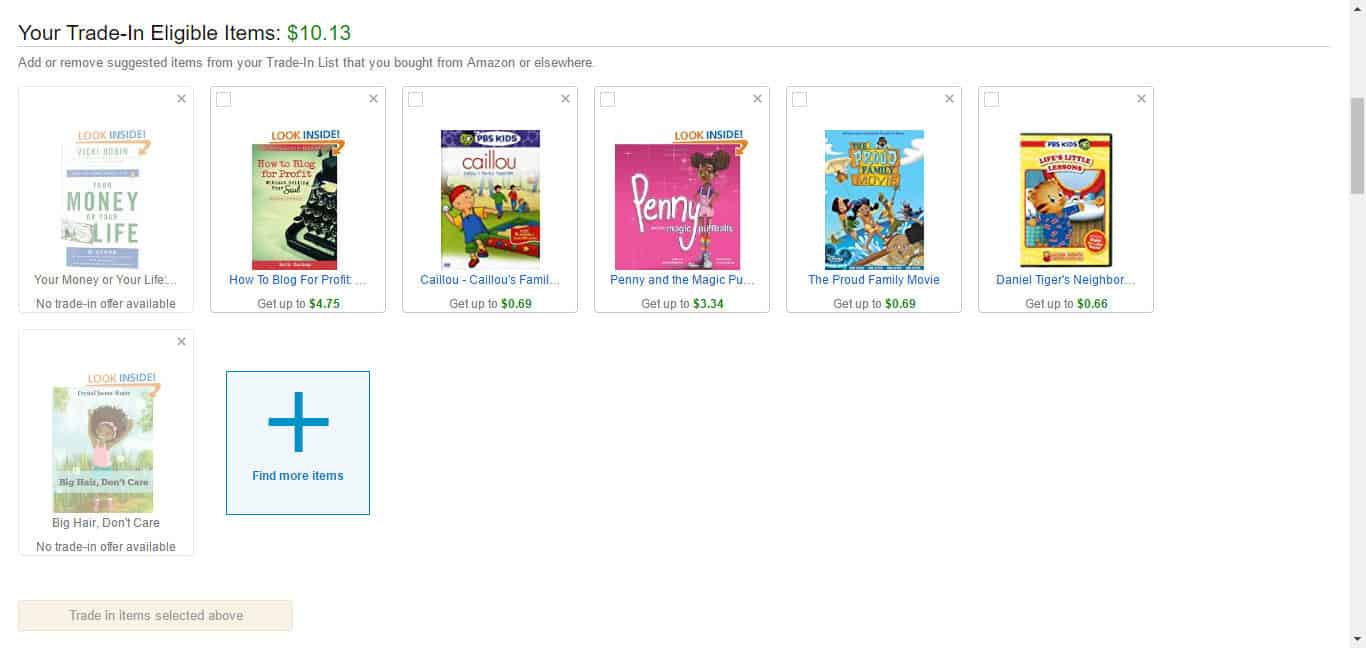

10) Sell things you no longer use through Amazon Trade-In.

If you have a bunch of books you purchased on Amazon that no longer read, trade those suckers in on Amazon Trade-In.

For example, when I go to my Amazon Trade-In page, it tells me I have $10.13 worth of eligible products.

If I were no longer using these items, I could ship them back in and get at total of $10.13 back. Depending on how many things you’ve purchased through Amazon, you could earn quite a bit.

Other items you can trade in are:

- Movies

- CD’s

- Video Games

- Video Consoles

- Phones

- Tablets

- Kindles

- Cameras

- Camera Lenses

- Calculators

- Wireless Routers

- Hard Drives

- And more!

11) Cut or reduce your cable package.

If you want to quickly add money back to your budget, cancel or reduce your cable package!

It really amazes me that more people aren’t taking advantage of streaming services like Sling TV or DirectTV Now. We have a Roku and Amazon Firestick that we’ve used to stream Hulu and Netflix for SIX years!

Just last year, we decided to try Sling TV for an additional $20 a month and we’re loving every bit of it. It’s like having cable and we’re only paying for the channels we need. I honestly don’t see us ever going back to being cable users again.

12) Slash your grocery budget by 20 percent for three months.

The easiest way I know to do this is by creating a rotating menu calendar based on what’s on sale for the week.

Let’s start with week one. During week one, buy double of the items on sale. For example, if your grocery store is running a sale on ingredients to make spaghetti, buy double of hamburger meat, spaghetti sauce, pasta, and frozen garlic bread.

For example, if your grocery store is running a sale on ingredients to make spaghetti, buy double of hamburger meat, spaghetti sauce, pasta, and frozen garlic bread.

Week two, repeat this same technique. If the grocery store has a roast and frozen carrots/onion/potato mix on sale, buy two of each.

On week three, you can eat the items you purchased on sale during week one. In week four, you will eat the things you purchased on sale during week two. When you’re stocking up, try to stay within the 20 percent budget reduction.

Most of the time I will create a rotating menu plan similar to this free one you can download (click on the link, click file, and make a copy). This will give you an idea of how to make it work for you.

If you would like a blank printable, click here (then go to file and make a copy).

Wrapping Thangs Up

Building your emergency savings is critical if you want to get ahead financially. Without it, you’re up the creek without a paddle (excuse my country-isms).

Although experts recommend having three to six months worth of emergency savings, don’t let this amount of money intimidate you and keep you from getting started.

It’s best to start small and continue to focus on building rather than how much everyone says you need. If you’re in the midst of an emergency, it’s even more important to know how to quickly come up with some cash so you won’t go into debt.

Hopefully, these twelve ideas will give you something to run with and you can keep your credit card tucked safely in your wallet. Don’t let a financial emergency stand between you and your financial freedom. Start saving today!