This is a sponsored post. All opinions are most certainly my own.

One way to get your budget under control is to cut monthly expenses. Easier said than done, right?

It’s annoying to get on the phone and call your cable or mobile phone company to get cheaper service. It’s frustrating being upsold to while you’re on the phone simply trying to save an extra dollar.

Until recently, I didn’t know there was a money saving app that could help you cut monthly expenses without having to call around to check prices. When I heard about Squeeze, I was immediately intrigued and knew this could be a major time saver!

Squeeze is a new app on the scene that makes life easier for folks. For those of us who want to reduce some monthly expenses and find extra ways to save in an already tight budget.

So today I want to share with you the reasons this app is so cool and how it can help you create a little wiggle room in your budget.

What Is Squeeze and How Can it Help Cut Monthly Expenses?

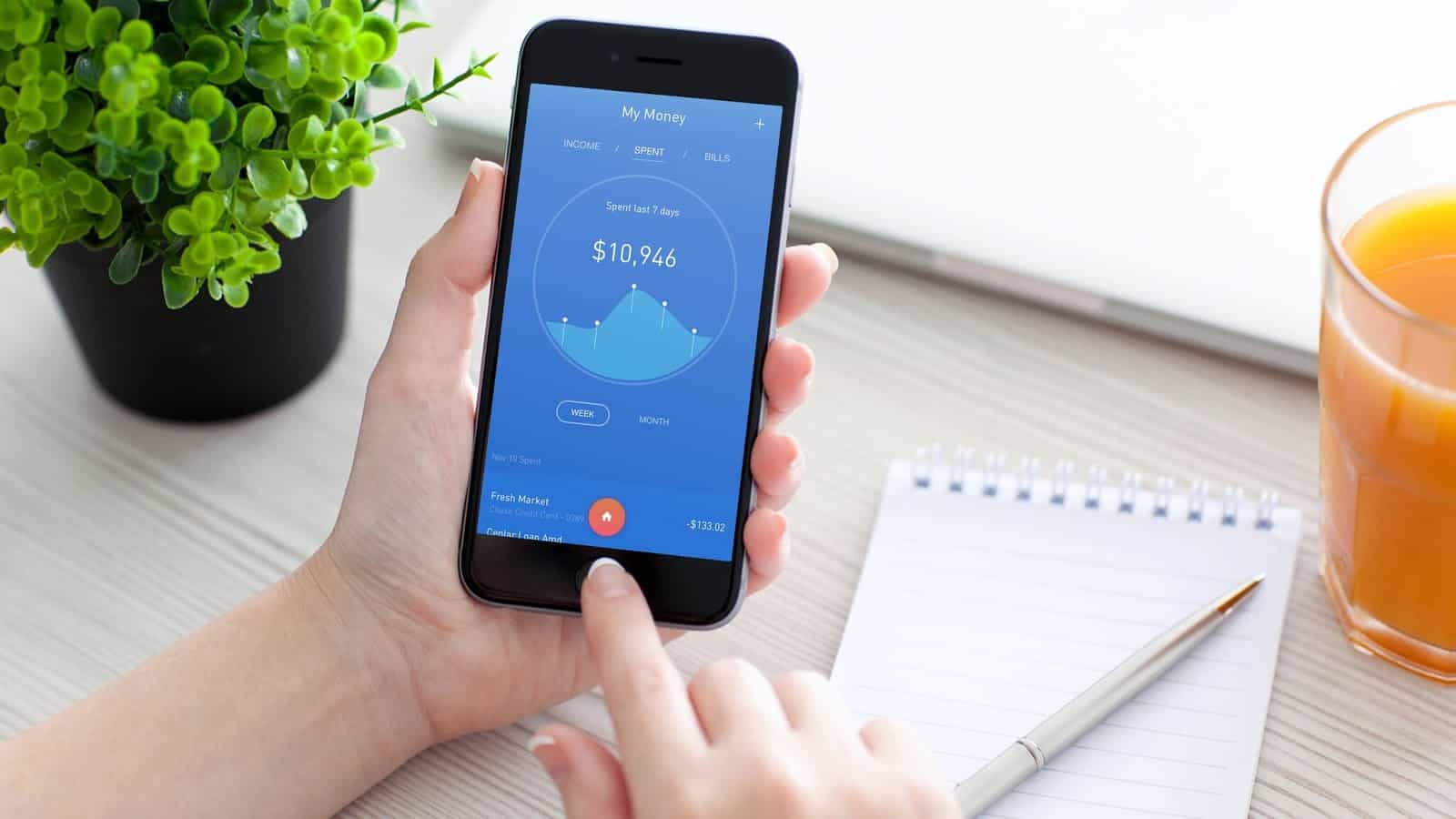

Squeeze is a downloadable app, available for Android and iPhone users, that allows you to connect your bank accounts. The app will track your monthly bills and daily spending.

The bill tracking system will give you the option to compare different service providers. This is how the app can help you save money. You can compare mobile packages, television subscriptions, and internet services.

When the app monitors your spending, they will provide you with advice on how to save on your everyday spending as well. The idea here is to figure out where your money is going and help you stay within your budget.

Finally, Squeeze provides financial insights to help you understand your bigger financial picture. You will gain a better understanding of how the suggested savings and price comparison models will help you get closer to your financial goals.

Related Reading: How to Create a Budget That Won’t Fail

Is Squeeze Right For You?

This app isn’t hard to use at all. You simply download the app into your phone, connect your accounts, and access your current situation. The app is secured by bank-level encryption, so you don’t have to worry about security.

Squeeze is totally free to use and is transparent with their price comparison tools. They are compensated by partners at no cost to you.

Squeeze is perfect for you if you can’t seem to cut monthly expenses. Sometimes it doesn’t seem like there is anything left to cut, so it’s good to have a handy app that does the hard work for you.

You simply compare using their tools and save money. That’s a win-win in my book. If a spending category isn’t available to squeeze on their app, you can email them with a recommendation.

Also, if you find a better pricing model, that’s offered elsewhere, they’ll take your email on that too. They try to offer the best prices available and want to know if there is something out there that’s better.

Wrapping Thangs Up

So basically, Squeeze is going to help you gain insights on your bills so you can reduce costs. It is also going to help you track and manage your spending and check prices on your recurring bills.

If you don’t want to be stuck on the phone trying to get the best deal from your current provider, this money saving app will do the heavy lifting for you. Just download Squeeze, connect your accounts and get ready to save money. Who knew there was such an easy way to cut expenses?

Have any of you tried Squeeze?