Student loan interest — I don’t know which is worse, the interest or the loans. Interest is basically money thrown down the drain because it’s money you pay the lender for borrowing their money.

The people, as I like to call them, charge you a certain percentage of the unpaid principal (or loan balance) that you are borrowing from them.

This creates an entirely different set of problems itself. Students (usually) borrow more than they should for college and once they graduate, they find it hard to make a dent in repayment efforts because of the interest rate.

If you don’t pay more than the minimum due each month, you are essentially prolonging the length of time it takes to pay off your loan. To make progress, it’s important to understand interest and how it impacts your repayment plan.

As I pursue my aggressive student loan repayment plan , I figure it’s as good as time as any to come to terms with the interest on my student loans.

To help you, I’m going to share my real numbers, how student loan interest is calculated, measures to fight back, and resources that will help you become more informed on student loan interest and the repayment process.

Student Loan Interest: These Are The Odds Stacked Against Me

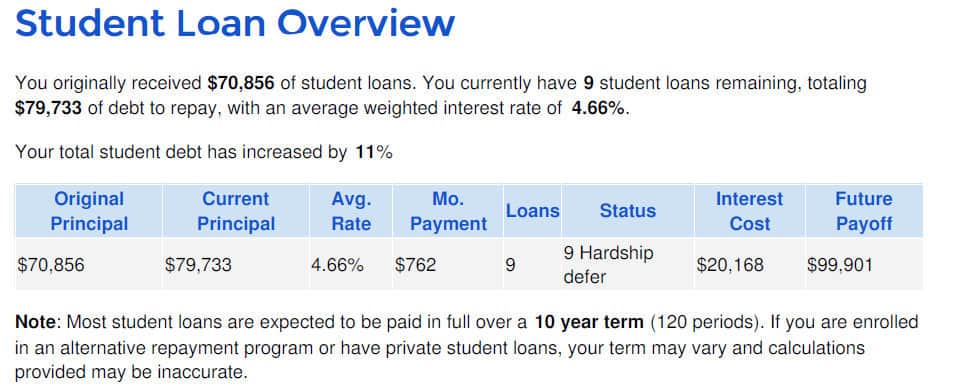

The screenshot above shows my current balance, interest rate, and payment under the income-based repayment plan. My economic hardship deferment on all the loans listed above recently ended and this is the current amount owed six days before the first due date, 06/28/2016.

Student loan interest is very confusing and honestly, this is my first time sitting down and trying to figure out how it’s making a difference in the total amount I will end up paying.

I wrote a post last year indicating I owed $79,000 in student loans. At that time, that amount was accurate, but as you can see, interest has increased my balance to $80,734.50!

The two loans at the bottom, number 8 and 9 are from my undergraduate studies. After graduating in 2006, these loans were consolidated into a Direct Consolidation Loan. The interest rates are so low on these; therefore, they won’t be on my plan of attack anytime soon.

I’m going after those loans with the higher interest rates first (this is considered the debt avalanche method). The higher interest rates vary, but I’m attacking the one with the smallest balance first. As of 7/8/2016, after making a $801.74 payment, the balance is $1869.

Who Determines Interest Rates?

Interest rates vary depending on the type of loan you have. Direct Loans (also known as Stafford Loans) are federal loans and they are dispersed as subsidized and unsubsidized loans.

Subsidized loans are available to undergraduate students with a financial need.

The school determines the amount you will borrow and you are not allowed to borrow more than the federal limits. As long as you’re enrolled in school at least half time, the US government will pay the interest accumulating on these loans during your enrollment. The government also pays interest during your six-month grace period after graduating and during any deferments.

Unsubsidized loans are available to both graduate and undergraduate students.

There are no financial need requirements and the school determines the amount you borrow based on other types of aid for which you may be eligible. The borrower is responsible for paying interest on unsubsidized loans during all periods and that includes forbearance, deferment, and grace periods. The interest also capitalizes.

With both types of loans, the federal government determines the interest rate and most are fixed. Private loan interest rates are determined by the lender. If you refinance your federal loans, the interest rates for these loans are determined by the lender too. Your lender may offer additional benefits such as interest rate reduction for signing up for auto-payment programs.

How To Calculate Your Interest

In my particular case, Direct loans (Stafford loans) accrues interest daily.

To determine the interest rate on a direct loan, you divide the interest rate on your loan (ex: 6.5 percent would be .065) by the number of days in a year, and then you would multiply this number by the total outstanding principal owed.

For those of you who are mathematically challenged (as I am), don’t worry. There are calculators available to help you figure out your interest.

Using these calculators, you can determine how much you will save by paying off your student loans early. Some other calculators are student loan refinancing, payoff or invest, and income-based repayment calculators, just to name a few.

It’s important to note one major thing about interest accrual on your loans. If you have unsubsidized loans and you enter into deferment or forbearance, interest will accrue daily on these loans. If you choose not to pay the interest, it will capitalize and be added to the outstanding principal owed.

Capitalized interest increases the average daily interest accrual on your loan. As a result, capitalized interest will increase your monthly payment and the amount you pay over the life of the loan.

How Can You Fight Student Loan Interest?

To make progress on your loans, it’s important to understand how payments are applied and allocated. To make the greatest impact, I studied how payment allocation and application works with my provider. It’s important to note the differences between allocation and application.

Allocation – When a lender says they are allocating payment, this means they are allocating (distributing) your payment across multiple loans.

Application – Once payment has been allocated to a portion or all of your loans, the amount is applied based on the terms of the promissory note. It typically is applied in this order — unpaid fees, unpaid interest, and finally unpaid principal.

By knowing this information, I understand how my minimum monthly payments are being used to pay off my student loan balance. As you can see, the method of applying the money towards unpaid interest first makes it difficult to speed up your payoff.

If you want to pay off your loans in a shorter timeframe than the typical 10 to 15 years for standard repayment (25 years for income based repayment), you have to be clear with your lender on how you want additional money applied to your loan. It pays to be well informed, friends!

My Repayment Plan

My loans are grouped together in one bill. After reading the information on my lender’s website, these are the instructions I must follow if I want to pursue an aggressive repayment plan. Note: this scenario applies only to loans that are current (paid to date). Other allocation and application methods may apply for loans past due or in default.

Once a payment is allocated to all the loans (loans 1 through 9), payment is applied in the following manner:

1) Accrued, unpaid interest,

2) Current principle balance,

3) Last, they will advance payment due date by the number of full payments unless directed to do otherwise.

The tricky part — they will apply anything considered an overpayment as an advanced payment. This means if I don’t send in directions, anything I pay over the $234.26 minimum payment will advance my due date. Um, no Sallie, Navient, or whatever the hell you’re calling yourself these days. That’s not how this is about to go down.

To ensure anything above my minimum payment is applied correctly, I have to send in my payment with instructions on a separate sheet of paper that specifies how I want the payment applied to my loans or I can call them with these instructions and make the payment.

Since I am targeting Stafford Loan – 02, I want all the extra payment I send to be applied to the PRINCIPLE balance. To make sure this is done properly after my monthly payment is made, I’ll schedule my big student loan payment earned from my side hustles to be applied towards the principal the day after my payment due date.

Why?

Well, remember, interest accrues daily, so the day after your scheduled payment is made this would be considered day 1 of the next billing cycle. This ensures your extra money is going towards more of your principle balance because your minimum payment has already been applied to any oustanding interest owed.

How Do You Determine The Amount of Extra Payment?

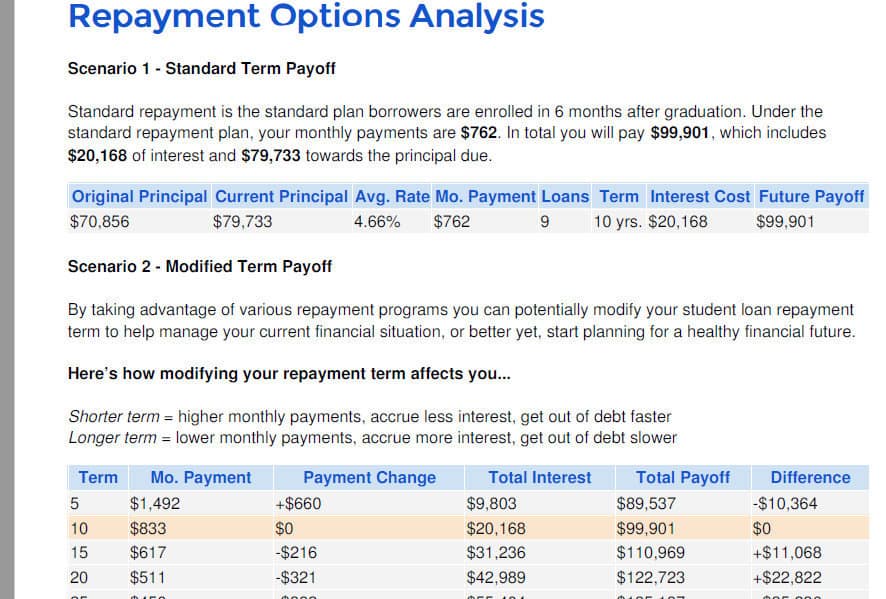

I used this free and very cool tool to create a student loan overview and repayment options plan. What I love about this report is it provides the total interest you will pay under your current plan and all other plans available. It also provides an estimate of how much you need to pay on your loans to pay them off faster. Additionally, it tells you how much interest you will save using an aggressive repayment plan versus a standard repayment plan. (SN: If you don’t like uploading all of your personal login and password stuff for your lenders on these types of sites, the calculators I mentioned will give you the same information)

The numbers in this report are from October 2015, however, I wanted to show you portions of the report so you can see the information being discussed.

Student Loan Overview

As you can see, the report tells me I initially borrowed $70,856 total and my student loan balance has increased by 11 percent since taking out the loans. The figures shown above show how much I will pay in total over the life of the loan under the standard repayment plan. Since I’m using an income-based repayment plan, this amount would be significantly higher if I were to pay it off 20 to 25 years later under this particular plan.

Repayment Plan Options

Based on the information provided above, this portion of the report allows me to determine my alternative repayment plan. The alternative requires decreasing the term and increasing the payment amount. Again, this information is based on the standard repayment plan versus the actual plan I’m currently on; however, this information helped me figure out what my target should be for my extra payment each month. I have determined that I need to shoot for an additional $1,500 payment each month.

(All of my extra payments will consist of side hustle income or any bonuses I receive from my full-time job. Based on my upcoming side hustle report I’m not far from reaching my goal either. As long as I gross $2100 per month, after taxes and estimated expenses for this site, I should be able to come up with $1,500 per month. Watch me work!)

Wrapping Things Up

I could rattle on all day about student loans or I could give you a few resources and let you carry on so you can come up with your own course of action. I’m going to go with the latter of the two and leave you with some sites that will help you figure out student loan interest, debt repayment, and a few other student debt topics. There are even a few blogs that serve up some great inspiration on paying off student loans. Hope you all learned something, now get on out there and defeat those student loans!

Those of you who are in the throes of tackling your student loan debt, how are you fighting your student loan interest? If you’ve paid off your student loans, what’s the best course of action you took? Please share in the comments below!

Resources:

StudentAid.ed.gov

StudentAid.ed.gov is an awesome website and this site alone will give you a bunch of information on student loans. I highly recommend starting with this one.

How To Tackle Your Student Loans

I wrote an in-depth overview of student loans that will provide you with a wealth of information you may need to pay off your student loans.

The Student Loan Knockout Course

I had the honor of checking out Zina’s (Debt Free After Three) course on student loans. There is a lot of information we think we know, but sometimes we have to face the fact that we just don’t know everything. Zina’s course offers some insightful information that some of you will benefit from. If you don’t have time to search for a bunch of outdated and/or irrelevant information, it will be refreshing to get all of it in one, well-written course.

Student Debt Survivor

Kari is a thirty-year-old professional who has paid off over $30,000 in student loan debt. She considers herself a Student Debt Survivor (SDS) and continues to share her experiences about paying off debt and future financial goals. Yes, need some of this in my life!

The Student Loan Lawyer

Josh is all about helping the people, y’all. He experienced a side of the financial aid system that no one oughta experience and became fed up with the not enough disclosure part of the student loan process. After working in the financial aid office, he is ready to part with some of his wisdom and help those who are struggling with student loan debt.

No More Harvard Debt

This blog is no longer updated, but Joe started it back in 2011 to share his journey with tackling $90,000 worth of student loan debt. He came up with a plan and paid those suckas off in ten months! Yep, you read that right. Ten months. Go check out what he did and see if any of his strategies will help you.