You may be asking yourself, “Is it better to pay off debt or save money?” and that’s quite a common question I receive as a financial educator.

You may be asking yourself, “Is it better to pay off debt or save money?” and that’s quite a common question I receive as a financial educator.

If you’re in debt, saving money shouldn’t be optional because, in the event of an emergency, the last thing you want to do is go further into debt. This is why I’m a firm believer that you should pay off debt and save money at the same time.

The amount you should save varies per individual. Dave Ramsey recommends saving $1,000 and then focus on paying off debt. However, each person should do what’s best for them.

If you have a mortgage and kids, you might not feel comfortable with having only $1,000 in savings for an emergency. If you’re single with no kids, this amount may be perfect for you.

Regardless of the number you decide on, you may still find yourself asking, “How can I save money while paying off debt?” If you’re living paycheck to paycheck, have a lot of debt, and very little money to spare, it can seem impossible to save any money at all or create a budget to pay off debt.

Well, there’s a way to make it happen and today I’m going to show you how. So, kick up your feet and settle in for a bit. Let’s focus on how you can pay off debt and save money at the same time.

How to Pay Off Debt and Save Money

1) Eliminate any non-essential expenses.

The very first step in managing to pay off debt and save money is monitoring your expenses. You have to make sure you don’t have any money leaks.

For instance, the most common types of leaks are automatic expenses that are withdrawn from your account that you’ve long forgotten about. You know that magazine subscription, unnecessary warranty or gym membership.

Take a look at your bank statement and highlight any expenses that you no longer need. This extra money is automatic savings without much effort.

Related Reading: How to Track Expenses So You Can Stick To Your Budget

The Best Budget Binder to Use This Year

2) Figure out how much money you owe.

You need a separate spreadsheet or list of all of your debts. Add all of them up to get a total of how much money you’re throwing at your debt each month.

3) Create a new budget.

Your new budget should NOT include the expenses you decided to eliminate in step 1, but it should include your total debt payment.

If the total of your new budget (current expenses and debt repayment) is greater than your income, you have an income issue that needs to be addressed. Take a look at How to Make More Money for help.

If you have extra money left over after your expenses and debt have been accounted for, this is great news! Now you just need to tell this extra money where to go.

Since you’re in debt, of course, you want to contribute some of it towards your debt payment. However, this is an opportunity to save as well.

Related reading: The Ultimate Budgeting Series

4) Decide what percentage you want to put towards debt.

This is an opportunity to build your savings muscles. If you’re not used to saving, you will get into the habit of doing so following this method.

You should decide what percentage of your leftover income you want to contribute to your debt and what percentage to put in savings.

For instance, if you have a leftover amount of $50.00, you may decide to save 5 percent and put the other 95 percent towards your debt.

Five percent of $50.00 isn’t much, but the amount you’re saving isn’t important. What’s important is that you learn how to save!

5) Make it automatic.

The next step is to make saving automatic! This is the easiest way to pay off debt and save money.

So, you’ve decided to save 5 percent of $50.00 each month. That’s $2.50 towards savings and $47.50 towards your debt.

Now, if you tried to set aside this $2.50 manually, it would be easy to spend it because after all, it seems like such a small amount. I mean, it doesn’t even seem worth it.

However, if you opened a separate account and set up an automatic deposit of $2.50 per month, the money is out of sight, out of mind.

If looking for an account with no fees, I recommend Chime. With Chime, you will have your own spending account and savings account. Sign up for auto-save and anytime you spend money, your purchases will be rounded up and you can save money.

Plus, if you sign up for direct deposit, you will get your paycheck 2 days early! Learn more about the benefits of using Chime here.

6) Make changes as you the amount of debt you owe changes.

We will discuss this more below. For now, just remember that you need to be prepared to make adjustments to your plan.

Let me give you an example of how one can pay off debt and save money.

Alyssa is a 33-year-old, engaged mother of one. She has a total of $8,000 in credit card debt.

She has no emergency savings, no savings for a wedding, and wants to be debt free before getting married.

Considering she has a child and a savings goal to pay for a wedding in cash, she needs a plan to help her build her savings and pay off her debt at the same time.

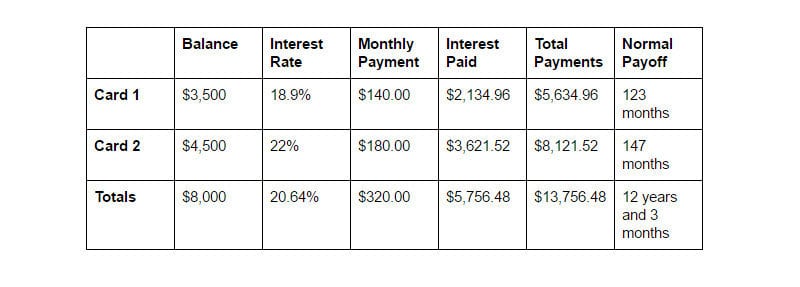

Here are the details for the credit cards below. This chart includes the amount of interest she would pay and the length of time it would take to pay off these debts if she continued to make the minimum payment.

Alyssa starts working the steps mentioned above.

1) Eliminate any non-essential expenses.

After an evaluation of her bank statement, Alyssa has determined there are many things she can cut out of her budget. Here is a list of the things she is cutting out of her budget, her reasoning, and how much it’s saving her each month.

- Daily lunch at the office (she can bring leftovers from dinner) = Total Savings $160

- Calls payroll to eliminate work gym fee (she can walk after work) = Total Savings $19

- Cable (she’s never home to watch television anyway) = Total Savings $140

- Kid subscription box (her daughter seems uninterested in it) = Total Savings $23

Alyssa has eliminated a total of $342 from her expenses. Maybe your savings won’t be as high as Alyssa, but take notice of the fact she cut out some smaller expenses that total $42.00. Even $42.00 could have a major impact on boosting your savings and eradicating debt!

Here are a few additional ways you could save more money:

- Check out these top 13 ways to earn FREE gift cards.

- Did you know that you may qualify for the Amazon Prime Discounted program? Prime is just $5.99 per month for qualifying customers in select U.S. government assistance programs, such as holders of an EBT card. If you receive assistance, sign up using this link for the free trial and more info on how to receive the discount and start saving on your online shopping.

- Save and earn money using Ibotta. Get a $10.00 bonus just for trying the app using this link!

- Get free identity-theft coverage by signing up to use Credit Sesame. This is a free tool that gives you your credit score and monitors your identity and you get $50,000 free in identity theft coverage. Learn More About Credit Sesame Here!

- Shop online using Ebates. If you’re new to Ebates, receive a $10 gift card to a retailer of your choice with your first $25 purchase. Try Ebates here for Free!

- Save money on eating out by using Restaurants.com.

- If student loan refinancing is suitable for your situation, check out LendKey and fill out their quick questionnaire and compare up to 5 different lenders.

- Sign up for Swagbucks and refer everyone! You even get Swagbucks for their Swagbucks (if that makes any sense). Plus, you’ll get a $5 gift card to a retailer of your choice for signing up. Free Amazon gift card, anyone?

- Cut your cable.

- Make sure you’re insured with the best insurance rates. Compare policies with Policy Genius to get the best term life insurance your money can buy.

- Purchasing a gift card for someone? Save up to 40 percent off gift card purchases here!

- Stop buying bottled water and get you a plain ole water bottle and fill it up.

2) Figure out how much money you owe.

Based on the chart above with Alyssa’s debt, the total amount of her monthly minimum payments is $320.

Some of you may be ready to stop here. Afterall, Alyssa just eliminated $342 from her monthly expenses. She has enough to save and pay her minimum so why go any further?

Well, she still hasn’t created a new budget that includes her savings and the amount she was already contributing to her debt.

Her previous budget already accounted for her monthly minimum debt payment of $320. What it doesn’t account for are the savings she earned by eliminating some of her expenses.

3) Create a new budget.

With her new budget, Alyssa is going to include her monthly minimum payment and the extra $342 she gained by eliminating her gym membership, lunches, kids subscription, and cable.

By doing this she will speed up her debt repayment and she will build her savings account. Let’s take a look at how it plays out.

Total Net Income – $2,200

New Expense Total – $1,858 (includes rent, utilities, minimum debt repayment, and other essentials)

Amount Left Over – $342

4) Decide what percentage you want to put towards debt.

Now using this information, Alyssa can determine the ratio she wants to put towards her debt and her savings. Since she has no savings at all and still wants to get rid of her debt, she has decided on 90/10 debt/savings ratio.

Each month she will take 10 percent of $342 and put it into savings. Her savings amount each month will be $34.20.

The remaining 90 percent ($307.8) will go toward her credit card with the highest interest rate (Card 2).

5) Make it automatic.

To make life easier she is going to automatically have her $34.20 deposited into her savings account. By the end of the year, she should have a $410.40, right?

Well, it could certainly work out that way if her situation stayed the same every month – but it won’t.

6) Make changes as the amount of debt you owe changes.

Each month Alyssa is paying an extra $307.80 towards her principle on Card 2. This card has $4,500 worth of debt and each month the principle is steadily going down. She will begin paying a total of $488 on this card each month.

In 11 months Card 2 will be paid off! Also, in 11 months she will have $376.00 in savings. This is when things can change for her.

With one credit card completely gone, she can now focus solely on Card 1.

She still has the same extra $342 extra + the $180 she was paying on Card 2 to put towards debt and use for savings ($522 total). This is when she decides to get more aggressive with her savings goal. She implements a 75/25 approach.

Using this approach, 75 percent of her extra ($391.50) will go towards Card 1 and $130.50 will go towards her savings.

She changes her direct deposit to reflect the changes and she begins putting $391.50 towards Card 1.

After paying this amount for 10 months, Alyssa is now debt free and has $1,715 in her emergency fund!

Once Card 1 is paid off that adds another $140 back to her budget. This brings her total extra money at the end of the month to a whopping $662.

Now that Alyssa has paid off $8,000 in debt and built her emergency fund to $1,000, she is planning to split this $622 in extra funds between her emergency fund and wedding fund.

Pay Off Debt or Save Money? Do both.

Of course, this situation is just an example, but Alyssa was able to pay off her debt in under two years versus the 12 years it would have taken making minimum payments. Plus, she built a nice starter emergency fund.

Maybe the amount of expense you can eliminate won’t be as much as Alyssa’s, but don’t be discouraged!

The purpose of this article is to illustrate how it is possible to pay down debt and save money at the same time. It doesn’t matter if it’s just $10, the savings will add up and the extra payment on your principal will decrease your debt over time.

You just have to stick with it and be committed! Work the steps:

1) eliminate expenses,

2) figure out how much you owe,

3) create a new budget,

4) determine your debt/savings ratio,

5) make it automatic, and

6) adjust as your situation changes.

It may take you a few months or a few years, but if you create a plan and make your savings automatic you will eventually reach your goal. Now, go do the work and after you pay off debt and save money, come back here and tell me all about it. I really want to know!