How to Organize Your Bills is the last post in the Ultimate Budgeting Series! If you’ve been following along, we’ve already gathered your income, tracked your expenses, created a savings plan, and built and refined your budget. Now, it’s time to get all of your budgeting materials organized, along with your bills. To read the entire series from the beginning, start here.

You’ve finally made it to the end. You know how much money you make and how much you’re spending. With this information, you’ve created your savings and your budget. Now it’s time to bring it all together. The purpose of this article in the series is to help you pull all of your materials together in an organized fashion. We’re also going to set up a billing system that will help you never miss a payment again. It’s simple and not very time consuming because you’ve already done the work. In the last article, Budget Management: How to Improve Your Budget, I asked you to get a three-pronged folder and a file box. Today we will use these to organize your bills. You will have a place to put your income, expense, and savings tracker — along with your new budget, online password tracker, and long-term/short-term financial goal sheets. So, without further adieu, let’s get right into how to organize your bills.

How to Organize Your Bills: Never Miss a Payment Again

Here are the printables applicable to today’s post. You can purchase the entire bundle for $5 here.

- Online password and website tracker.

- Long-term and Short-Term Financial Goals.

- Bills to Pay Checklist

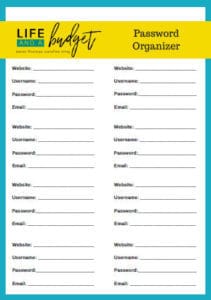

Online Password and Website Tracker

Online Password and Website Tracker

The online password and website tracker is a good thing to have. This will help your partner or any other designated person have access to your accounts in case of an emergency. It will also help you keep up with all of the million passwords you need to pay your bills. I just updated my password sheets because I had them everywhere. I had printables, books, etc. It was just too much to keep up with. These worksheets make it easier.

Long-term and Short-Term Financial Goals

Long-term and Short-Term Financial Goals

I created these so you can just get a quick glimpse of your long-term and short-term money goals. Even though you may not be able to tackle all of your goals at once, it’s good for keeping them on your mind. Once you complete one goal, you can mark it off and move on to another one. I would write these goals in pencil because your goals can change over time.

Bills to Pay Checklist

Bills to Pay Checklist

If you’re anything like me, you sometimes forget what you’ve already paid for the month. Most of my bills are set up to automatically come out of my account. However, there are a couple of bills I have to manually pay each month. I created this bills to pay checklist so I can mark it off as done. I index my bills in a file folder labeled paid when I pay them so it’s easy for me to forget what I paid. I don’t like going through my paid file folder to see if I paid it or not, so this checklist will remind me with one glance. Simply write the bill on the sheet that was paid and check it off. Easy peasy.

How to Organize Your Bills

Here’s how you can set up your system

- When a new bill comes in the mail, file it in a folder that says – to be paid.

- After the bill is paid, move it to a folder that says – paid.

- Add all of your worksheets you’ve downloaded to your three-pronged folder (or binder…whatever you like) and add it to the back of the file box. If you decided to use a notebook to track expenses/income etc, you can improvise and file it in your file box.

Wrapping Up

That’s it! Seriously, you thought this was going to be one of those long, drawn-out processes, didn’t you? Nope! I like to keep money management simple and I’ve used this process for years. It makes it easier for my husband and me to keep up with the bills. Hopefully, it will work as smoothly for you as it does for me.