One quick search for a 52-week money challenge template and you’ll easily find a plethora of weekly savings charts to help you begin your journey. But what about us folks that hate looking at charts? What’s out there for us?

One quick search for a 52-week money challenge template and you’ll easily find a plethora of weekly savings charts to help you begin your journey. But what about us folks that hate looking at charts? What’s out there for us?

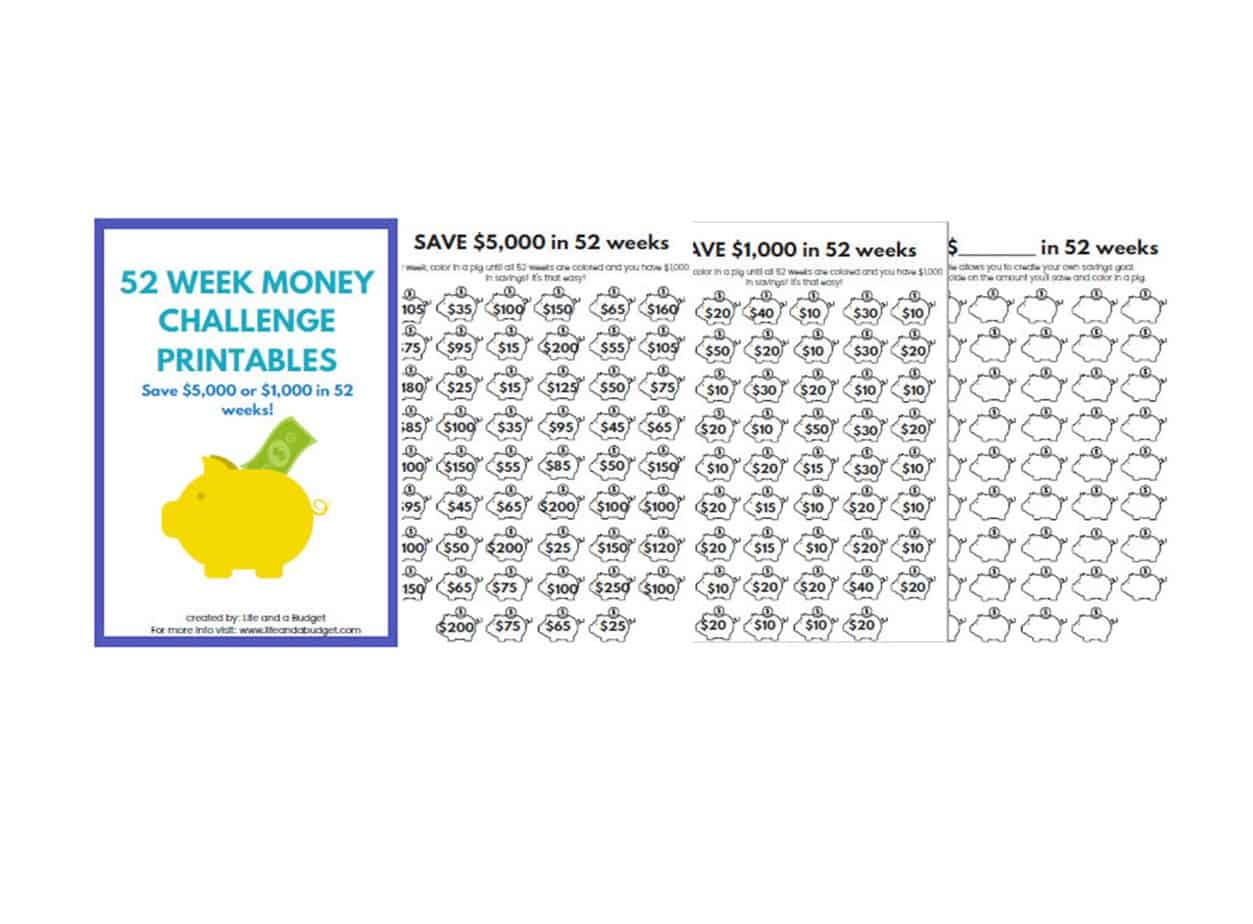

Well, to my dismay, there wasn’t much, so I decided to do something about it. Now, I’ll warn you, if you want a savings chart, you won’t find it here. This 52-week money challenge template is super cute, super fun, but it still works!

So, go ahead and pull your markers, crayons, or coloring pencils out because you’ll need them. I want to introduce you to a set of 52-week money challenge pdf printables that are actually coloring printables!

Yep, no savings charts here…you’ll be coloring and building your savings muscles at the same time. And we’re not talking chump change either. These money challenge templates will help you save $5,000 or $1,000 this year.

How The 52 Week Challenge Works – Download The Templates

It’s actually pretty simple:

1. Download the 52-week money challenge pdf here.

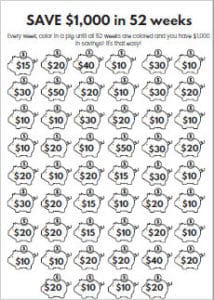

2. Every week, save an amount in one of the piggy banks for the week.

3. Color in the piggy bank when your deposit is made.

4. Watch your savings build up.

Your final balance at the end of the year will depend on which 52-week money challenge template you’re using. One printable will help you save $5,000 in a year. The other will help you save $1,000. Also, I’ve included a blank printable so you can put the amounts you want to save in each pig and color as you go.

Related Reading:

3 Month Money Challenge – Save $1,000

26 Week Money Challenge – Save $5,000 or $1000

12 Week Christmas Savings Plan: Save $1,000 by Christmas

6 Savings Accounts Every Family Needs to Have

Savings Tips For Beginners: How to Start Saving Money

Why You Should Use The 52 Week Money Challenge Template in 2021

These money challenge templates will make savings fun. If you’re a visual person, you can see your progress throughout the year and stay encouraged. Plus, it helps you hold yourself accountable.

These money challenge templates will make savings fun. If you’re a visual person, you can see your progress throughout the year and stay encouraged. Plus, it helps you hold yourself accountable.

Just imagine at the end of the year you could possibly have $5,000 more than you started the year with. That itself is motivating enough, but when you have pretty coloring printable in lieu of your typical weekly savings chart, it makes it so much better.

Last, using a 52-week money challenge template in 2021 will give you plenty of time to make saving money a habit. This is a habit all of us could use and it will help you prepare for future emergencies or unexpected expenses.

Make The 52 Week Money Challenge Easier

So, I know you’re probably asking yourself, “where the heck will I find the extra money to save $5,000 or $1,000 in 52 weeks?” Well, the answer to that is simple. You must MAKE more than you SPEND.

It’s easy enough to find ways to cut back on your spending. For example, in one month, you could do the following to cut your expenses:

- Sign up for Trim. You can sign up for free and they’ll analyze your spending and help you cancel unwanted subscriptions, find better car insurance, and negotiate bills like cable and cell phone.

- Sign up for Ibotta and receive cashback on grocery and mobile shopping. You will get a free $10.00 Ibotta welcome Bonus when you redeem your first rebate. You can add that to your savings!

- Create a meal plan, so you will stop eating out.

- Also, you could incorporate some of these 150 frugal living tips to help you reduce your expenses further.

All of these are a great place to start, but let’s be realistic — there’s only so much cutting back one can do. So, then what do you do?

Earn extra cash for this money-saving challenge

Once you’ve cut your spending, it’s time to look for ways to make extra cash so you can complete your 52-week money challenge. Here are some quick ways you can earn extra cash to help you save more:

- Sign up and for Lyft. They offer a $300 bonus to drivers that could boost your savings!

- Sign up for Shipt. If you’ve never heard of Shipt, it’s basically a grocery delivery service. Customers use an app to buy groceries, you do the shopping for them and then deliver their groceries. They pay pretty well too.

- Sign up for Swagbucks. Check out this post on how you can use Swagbucks and reach your savings goal a little faster.

- Check out over 100 more side hustles to help you complete this money saving challenge!

Related Reading:

The Top 13 Side Gigs to Make Extra Money in 2019

Chime Bank: Get Paid Early and Get Paid to Save

How to save money for the 52 Week Money Challenge?

Quickly, let’s discuss some key points that will help you achieve this goal:

- Treat your savings as a bill. If it’s tough for you to follow the 52-week money challenge template, set up an automatic transfer into an online savings account for $417 per month(to save $5,000) or $84 per month (to save $1,000) for 52 weeks. You could even break it down further do automatically save bi-monthly, bi-weekly, or weekly. If you sign up with Capital One, you can specify the time period for automatic savings transfers and specify the amount. If you treat your savings like a bill, you won’t have to worry about not completing the challenge because it’ll be taken care of for you.

- If you choose to do it this way, visualize each step of the way with your 52-week money challenge template. Every time you get an alert saying that your bill to yourself has been paid, color it in on the savings plan printable.

- Start small and end big. If you need to, begin the challenge by starting small and increasing your savings amount as you progress. This helps you build your savings muscles!

- Make sure you use the money for it’s intended purposes. Don’t do all of this work to blow your savings on something you don’t need. Use it for your emergency fund, dream fund, or to stay a month ahead of your bills.

- If you would like to keep track of your savings progress via excel, here’s the perfect 52-week savings plan spreadsheet to guide you.

Download Your 52 Week Money Challenge Template Today!

As we wrap this up, remember these important things as you prepare for this money challenge:

- Click on the picture above and print out your 52 Week Money Challenge Template or use the 52-week savings plan spreadsheet.

- Earn more income so it won’t feel like you’re scrimping to get by.

- Every week after you make a deposit, color in a piggy bank.

- Keep your money in a separate savings account so you won’t be tempted to spend it!

- Keep going because your efforts will be rewarding!