Today I’m sharing this sample family budget (which is actually our REAL family budget).

Today I’m sharing this sample family budget (which is actually our REAL family budget).

Many folks I work with struggle to create their own budget because there aren’t that many monthly budget examples available that are actually realistic. And when I say realistic, I’m talking about folks that are struggling to find the balance between saving and paying off debt.

Well, fret no further. In this family budget example, you’ll see exactly how we manage to create a budget for a family of 4.

We live in the south, just about 20 to 30 minutes from our state’s capital and major downtown city. We’re fortunate to have a mortgage payment that’s way cheaper than the one-bedroom apartment we lived in back in 2009 (I know, crazy right?!).

With that said, take what you can from this sample family budget and use it to create your own.

Take into consideration the cost of living in your area and make adjustments where necessary.

Just know that you don’t have to make a huge income to make a family budget work for you. You just have to adjust your numbers and spend money based on your priorities and your needs.

A great tool to learn how to successfully budget is the LAAB Budget Binder.

What are typical household expenses?

Before we get started, let’s go over some typical household expenses that you may have. This will be helpful when creating your own family budget. Some of the most common household expenses may include the following:

- Mortgage/Rent

- Auto/Transportation

- Childcare

- Groceries

- Debt Repayment

- Entertainment

- Hobbies/Extra Curricular Payments

- Utilities

- Savings

Check out this post for a more extensive list and tips on tracking your household expenses.

Our Family Budget Example for a Family of 4

| Mortgage | $691 |

| Electricity | $196 |

| Water | $40 |

| Sewer | $46 |

| Gas | $120 |

| Groceries | $400 |

| Car Insurance | $131.50 |

| Vehicle Taxes | $36.88 |

| Entertainment | $19 |

| Personal Hygiene | $25 |

| Internet | $52 |

| School | $50 |

| Life Insurance | $62 |

| Cell | $119 |

| Car Payment | $335.32 |

| Medical Bill | $50 |

| HVAC Bill | $112.77 |

| Student Loans | $150 |

| Savings | $95 |

| Total Household Expenses | $2750 |

Our monthly income fluctuates, but our bottom line income number is $2800 per month.

For things like our vehicle taxes and emergency funds, we created separate savings accounts with Capital One 360 so we can divide the total amount by the number of paychecks and have them automatically directed to one of those accounts. This way when the bill comes, we have the money to pay it.

I recommend this method for anyone who struggles to come up with car insurance premiums, homeowners insurance, etc. Just save a little from each paycheck to cover the cost when it arises.

For more information on how to successfully save for annual, bi-annual, or quarterly payments ― check out this post.

How do you write a family budget?

The easiest way to create a family budget is to simply start with what you know. All this means is that you need to write down how much money you bring home every month.

The second thing is to write down every bill that has to be paid each month. Once you’ve done those things, you have a rough draft of your first budget.

Once you know those two numbers ― how much you’re earning and how much you’re making, you can create financial goals, identify whether certain expenses are necessary, and a plan for your future.

To help you write your first family budget, below are a few resources you might find helpful.

A Sample Family Budget Worksheet

Use this household budget template printable as you write your first family budget. It’s basic and it asks you for all the information you’ll need as you build your own monthly budget example.

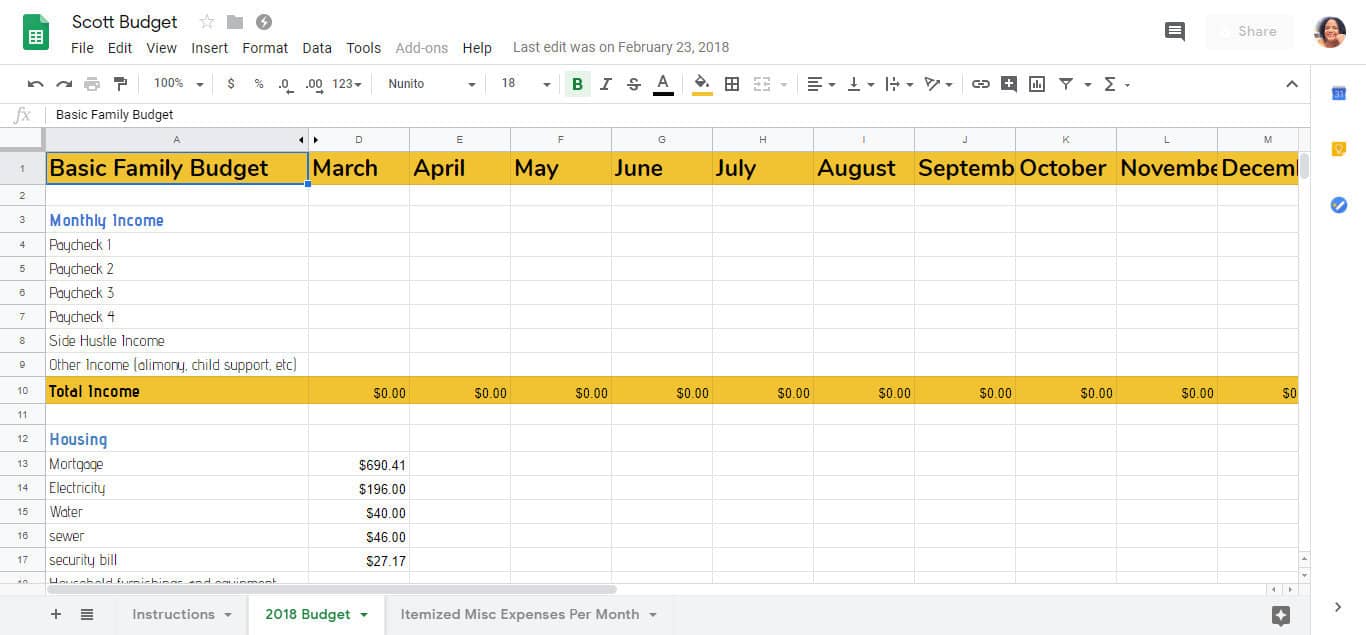

A Free Household Budget Spreadsheet

If the free household budget worksheet pdf isn’t your cup of tea and you prefer to use a spreadsheet, use this free budget spreadsheet template.

Read The Budgeting for Beginners Series for additional help on creating your own family budget. Plus, there are some helpful budgeting printables included with the series that will make life a lot easier.

Other Sample Family Budgets

- Sample family budget for a family of 8

- Monthly budget example for a one income family of 5