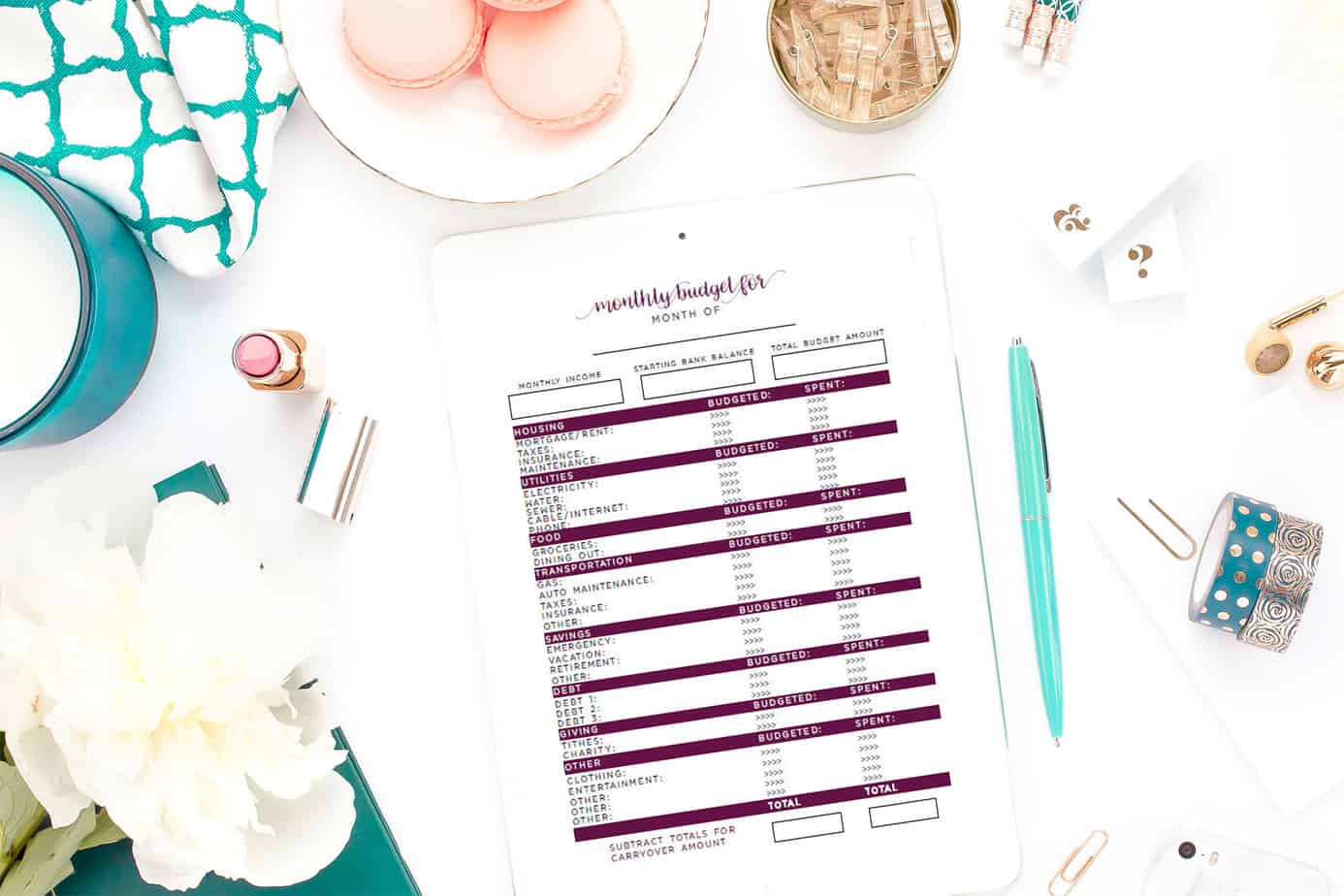

Simple budget worksheet – this is what you’ll use today to build your budget! If you’ve been following The Ultimate Budgeting Series, we’ve already gathered your income, tracked your expenses, and created a savings plan. Now, it’s time to put your income, expenses, and savings into a budget. To read the entire series from the beginning, start here.

This is where things gets real. See, I had you do savings before creating a budget for a reason.

Your savings goals need to be identified first because usually when people budget before savings, they will create every excuse in the book to why they’re saving.

It usually goes like, “I don’t have enough money leftover.” You shouldn’t be saving what’s left over after you’ve paid everyone else.

Now that you know your income, your expenses, AND your savings – you need to fit these numbers into a budget to see if your wants and needs balance out to zero.

If not, the last thing you want is to forgo savings just so you can live above your means! What you really want to do is cut your expenses.

To get started, grab some wine (you may need it) or tea, your income, your most recent expense worksheet, and savings tracker.

Grab your bills, bank statements, calculator, and pencil. Also, download the simple budget worksheet I created just for the series.

Now, you’re ready to do some work.

Let’s Examine Your Expenses

Previously, we didn’t do too much with expenses. You just wrote down a list of things you spend your money on. Your trackings should have included normal day to day spending and regular expenses like your mortgage, debt payments, and utilities.

Now that you have your list of expense, we need to identify them as variable or fixed expenses. But first, let’s define what fixed and variable expenses are so we’re clear…

Fixed Expenses – these types of expenses usually stay the same from month to month. They include expenses like your mortgage/rent, car payment, cable, and phone bills.

Variable Expenses – these types of expenses can change month to month. These include house maintenance, clothing, food, auto maintenance, gas, electricity, and water.

Identifying your expenses as fixed or variable is very important. You need to know which numbers in your budget are set in stone. This will also help you determine what to cut back on if necessary (more on that later).

So, on your expense tracker, put an F besides all of your fixed expenses. Put a V beside all of your variable expenses.

Once you’ve done this, you can start putting your numbers into the simple budget worksheet provided in the budgeting series printable pack or map it out on paper. If you’re good with spreadsheets, you can use this one.

How to Use a Simple Budget Worksheet

How to Use a Simple Budget Worksheet

1) Begin by filling out the budgeted column of the simple budget worksheet, starting with housing.

Most of the items categorized under housing are fixed expenses. Some of the utilities are fixed as well. Also, consider any debt payments fixed expenses.

If you have credit card debt, stop using your cards. As you put in your credit card payment, put in an amount that’s higher than the minimum. This will help you pay off your credit card quicker. Read this article more info on paying off credit card debt.

Remember, your fixed expenses like housing don’t usually change from month to month. If there are some expenses you haven’t accounted for on your worksheet yet, get a copy of your bills or bank statement to find the numbers.

2) Now fill out the rest of the simple budget worksheet.

Since your variable expenses can change, I would work on finding out the average you pay each month. For example, let’s say your last three water bills have been $27, $36, and $25.

Add these together and divide by three for an average payment of $29.33. Round up to $30 and use this number for your worksheet. Do this for all other variable expenses.

3) Now that you have the entire budgeted column filled out, add up the column.

After a bill has been paid — enter in the actual amount you spent in the spending column.

Why?

Well, this will help you to create a little cushion in your account. See, with your variable expenses changing every month, you want to make sure you have enough in your account to handle any future unforeseeable payments.

Instead of taking out any extra money you budgeted but didn’t spend, it can stay in your account to handle any fluctuations.

Now, you’re not through yet.

- Add up the total for the spent column and the income column.

- Add this to the bottom of the worksheet.

- Subtract your total income from your total expenses.

It’s preferable this number is at zero. Being at zero would suggest you gave every dollar an assignment.

If there’s a surplus, remember that’s okay too. It will cover your future variable expenses and give you the opportunity to reward yourself.

Use Your Simple Budget Worksheet to Determine Your Budgeting Success

Here’s where things will get interesting. If your budget ended with zero, you’re good. If you had a surplus, remember that’s okay too.

You’ll probably use it next month. However, if you have a huge surplus, you might not be saving enough.

If that’s the case, go back and make sure you’re saving enough for emergencies. For those of you with no debt, make sure you’re saving enough for something fun!

Likewise, if your final number is negative — it’s time to get to work. This means you’re living above your means. If you didn’t have enough money in your checking account, you did one of two things:

- You either had some overdrafts

- Or you used debt to cover some expenses.

Neither one of these two things is good! Overdrafts result in bank fees that you obviously don’t have the money to pay. And debt means you’ll be paying more interest.

Here’s what you can do to solve this problem – increase your income and/or cut expenses. I would recommend a little combination of both.

See, if you can increase your income, you can get out of debt quicker. Because let’s face it, if your expenses exceed your income, you more than likely have some debt.

Once you get out of debt, you can build your emergency savings and get ahead of your expense.

Also, if you decrease your expenses, you’ll be adjusting your lifestyle to reflect your current income. There are many expenses you probably don’t want to part with, but is it really worth going into debt over?

Some expenses you could cut are:

- Cable

- Cell phone (You can get a phone plan for as cheap as $15 with Republic Wireless)

- Internet

- Housing

- Gifts

- Food

- And more

Variable expenses are usually the easiest to cut. For example, you could easily cancel your cable subscription or call to lower your insurance premiums.

You could try to bundle your internet or phone. Last, you could cut your food expenses by meal planning and cooking more at home.

Start with these expenses and see if you can bring them down. If that doesn’t work, make some hard decisions about your fixed expenses like housing.

Could you move to a cheaper area? Maybe refinance your mortgage to a cheaper interest rate? Get rid of a car to eliminate your car payment. Here are some more ideas on saving money.

Continue eliminating until your final difference between expense and income is zero or positive. And that’s it. This is how you budget.

Next, in the series, we will discuss ways to refine your budget. Creating the initial budget is always a challenge, but the hardest part is sticking to it.

Don’t worry, though, I have some tips that will make it easy to hone in on the practice of successful budgeting.

Your Next Steps

- Print your simple budget worksheet. If you haven’t downloaded the series printable, you can purchase them for $5.

- Fill it out using the techniques discussed

- Ask any lingering questions you may have in the comments.

- Prepare for the next step in the budgeting series — refining your budget.

Are you budgeting for success? Weigh in!